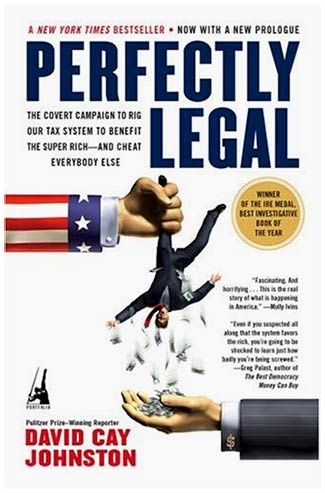

The Covert Campaign That Rigged U.S. Tax System to Benefit The Parasite Ruling Class

- By David Cay Johnston

The Covert Campaign That Rigged U.S. Tax System to Benefit The Parasite Ruling Class, thus Cheat Everybody Else (Portfolio, 2003)

The Covert Campaign That Rigged U.S. Tax System to Benefit The Parasite Ruling Class, thus Cheat Everybody Else (Portfolio, 2003)

This summary is made by Chuck Collins, United for Fair Economy.

“The Republicans’ mantra to their corporate buddies is ‘Friends don’t let friends pay taxes.’”

–Rep. Lloyd Doggett (D-TX)

“Instead of drilling for oil and gas, Enron was drilling the tax code, looking for ways to find more and more tax shelters.”

–Sen. John B. Breaux (D-LA)

“Attorneys and accountants should be pillars of our system of taxation, not the architects of its circumvention.”

–Mark W. Everson, Commissioner of the IRS, 2003

This is the long-awaited book by David Cay Johnston (DCJ), who won the Pulitzer Prize in 2001 for his beat reporting on tax issues. DCJ wrote a number of important stories about the estate tax – and broke the story of Responsible Wealth’s “Call to Preserve the Estate Tax.” One comment relevant to our work: “And the critics who have decried the growing concentration of wealth and power at the top have been wrong – because they have seriously understated the transformation now taking place.” (p. 19)

For someone knowledgeable about the inequities of our federal tax system, the picture Johnston paints would shock even a cynical mind. He chronicles a tax system on the brink of a fundamental legitimacy crisis, one that has been deliberately engineered and works in the interest of the very wealthy. In sum:

The tax system is being used by the rich, through their allies in Congress, to shift risks off of themselves and onto everyone else. And perhaps worst of all, our tax system now forces most Americans to subsidize the lifestyles of the very rich, who enjoy the benefits of our democracy without paying their fair share of its price. (p. 19)

Johnston eloquently argues that this represents a tax SHIFT – with the slack picked up by the poor, the middle class and even the lower rungs of the upper classes. Among those “hurt” by changes in the tax system are those whose incomes rise as high at $500,000 a year – for even this wealthy group has gotten the shaft in favor of the super-super rich.

This book is a plea for citizen vigilance to stop the auction of our nation’s laws and tax rules to the bipartisan “party of money.”

The book begins with a profile of Jonathan Blattmachr, a tax attorney for the old wealth firm Milbank & Tweed, and architect of tax avoidance strategies for the $10 million and up set. “As all economists are taught, there is no free lunch. Blattmachr’s clients just leave part of their bill on your table.” (p. 11) DCJ argues there are two tax systems:

Congress lets business owners, investors and landlords play by one set of rules, which are filled with opportunities to hide income, fabricate deductions and reduce taxes. Congress requires wage earners to operate under another, much harsher set of rules in which every dollar of income from a job, a savings account or a stock dividend is reported to the government, and taxes are withheld from each paycheck to make sure wage earners pay in full. (p. 10)

“…When it comes to taxes, it often pays to cheat so long your income is not from wages.” (p. 14).

Johnston observes that we have essentially a flat income tax system. The rich pay a large share of federal income taxes. The richest 1 percent, those with $330,000 or more in 2000, earned 21 percent of all reported income and paid more than 37 percent of individual federal income taxes (p. 11). But factor in all other federal taxes – beer, gasoline, Social Security – the top 1 percent’s share drops to 25 percent.

If you tally up the economic benefits to the top 1 percent that do not show up in income statistics – for reasons of written law and because of tax tricks fashioned by lawyers like Blattmachr – then the richest 1 percent are taxed more lightly than the middle class. The same data show that the poor are taxed almost as heavily as the rich are – and even more heavily than the superrich. (p. 11)

DCJ shows how the tax burden on the top 400 has gone down. During the Clinton years, the share of income going to the top 400 taxpayers doubled from 0.5 percent to 1.1 percent. But the top 400’s portion of income going to federal income taxes fell by 18 percent, while rising for everyone else by 18 percent! (p. 308)

Trends that Johnston writes about:

Corporate executive compensation games – such as deferred compensation – mean that executives don’t have to pay income tax. Congress allows them to put it off for decades. Chapter 4 “Big Payday” tells the story of Coca Cola’s Roberto Goizueta’s $1 billion dollar payday, thanks to taxpayers.

Corporate perks – such as private jets – are an obvious way that government allows the rich to enable the rest of us to subsidize lavish tastes and luxuries. Ms. Welch’s divorce suit against husband Jack Welch gave us an extraordinary window into the world of executive perks. DCJ tells the legislative history of how owning a private jet can be cheaper, after tax deductions, than flying coach – and how Senators sneaked the provision into the law despite vigorous objections of Sen. Howard Metzenbaum (Chapter 5, “Plane Perks).

Alternative Minimum Tax – Chapter 7 on the “Stealth Tax” talks about how the Alternative Minimum Tax, created to require the rich to pay some taxes, is creeping up the income ladder and capturing many middle-income households that won’t get their advertised Bush tax cut. The Bush administration is not doing anything to change this, fomenting a political backlash that will probably enable them to get rid of the entire AMT, not reform it. “By 2010 about 85 percent of all taxpayers with two or more children will be forced off the regular income tax and onto the alternative minimum tax.” (p. 113) The cost of repealing the AMT in 2003 is $950 billion, assuming that all the 2001 tax cuts are made permanent.

Social Security as Tax Shift – In Chapter 8, DCJ argues that the decision to raise Social Security withholding on workers – and give away tax breaks to the rich – is one of the cruelest shifts.

In the two decades beginning in 1983 the government has spent almost $5.4 trillion more than it took in from income, estate, gift and excise taxes. The reason that government debt grew by a smaller though still gigantic figure, $3.6 trillion, was because those excess Social Security taxes that were used to finance income tax cuts for the rich.” (p. 123)

This was a political choice that hurt the three-fourth of taxpayers who pay more in Social Security withholding than they pay in income taxes. “Those excess Social Security taxes rob many of their capacity to save, while tax cuts for the rich expand that group’s capacity to save.” (p. 306)

Overseas Tax Avoidance – Corporations have not just slashed their tax bills by reincorporating in other countries, but also through transactions that shift some of their tax liabilities overseas – and reducing what they pay at home. “You pay for this through higher taxes, reduced services or your rising share of our growing national debt.” (p. 12)

The goal is to “take expenses in the United States and take profits in countries that impose little or no tax.” One effective way to do this is to shift intellectual property – patents, logos, etc. to other countries and pay use rights to the foreign subsidiaries.

Weakening Enforcement and Shifting Resources to Working Poor – Congress has weakened IRS enforcement, particularly of the very rich. The IRS enforcement arms have been handcuffed and discouraged from pursuing tax cheats.

At the same time, they’ve increased oversight of low-income people who file for the Earned Income Credit (a Clinton administration compromise to keep the program from being cut). Chapter 9 –“Preying on the Working Poor” – documents this skewed focus.

“The IRS audited 397,000 of the working poor who applied for the credit in 2001, eight times as many audits as it conducted of people making $100,000 or more.” That works out to one of every 47 returns seeking the credit, compared to one in 366 taxpayers who did not apply for it.” (p. 130)

Meanwhile, in 2002, the IRS assessed just 22 negligence penalties against 2.5 million corporations, a decline of more than 99 percent from 1993 when nearly 2,400 penalties were imposed. (p. 139) In Chapter 10, “Handcuffing the Tax Police,” DCJ shows how conservatives in Congress put enormous scrutiny on the IRS – dramatized by Sen. Roth’s oversight hearings to defang IRS enforcers. “They were part of a strategy by a segment of Washington Republicans to win votes by going after the IRS and the tax system.” (p. 153). Chapter 11, “Mr. Rossitti’s Customers,” describes how the IRS commissioner overhauled the IRS to make it “customer oriented” and totally weakened its ability to crack down on tax cheats. Audits on the wealthy plummeted, the reason “was entirely the change in the way IRS resources were used. But the effect was also sure to reduce complaints by those in the political donor class about IRS agents harassing them.” (p. 165).

Corporate partnerships have become one of the great tax avoidance devices. One involved joint ownership with a nonprofit corporation, often a life insurance entity that allowed for massive shelters. “Chapter 12,” For Want of a Keystroke” and Chapter 14, “Mr. Kellogg’s Favorite Loophole” talks about these scams. One aggressive IRS official, who really understood the role of partnerships in tax avoidance, suggested a few pieces of information to collect on IRS tracking that would help clue them into aggressive avoidance. But the resources were not there, even though these suggestions would bring in billions of lost revenue.

Massive tax avoidance has been advocated by some crackpots who claim the laws have no legitimacy. These rebels get aid and comfort from DC lobbying groups like Center for Freedom and Prosperity, a group the New Republic calls a “lobby for tax cheats.” DCJ exposed a lot of these visible scammers, who sold their services to people trying to avoid taxes—and a few have gone on trial as a result.

But the real culprits are the silent tax avoiders, who shift assets, ownership and income to overseas tax shelters, like the Cayman Islands. One investigator estimated the US loses $70 billion a year to offshore tax fraud. IRS summoned credit card companies to identify overseas accounts with credit cards…230,000 were turned over. Few were pursued.

Tax Shelter Industry – Chapter 16 “Profiting off Taxes” describes all the big accounting firms who sell tax avoidance. One law professor defines a tax shelter as “an investment that is worth more after-tax than before tax.” (p. 220) Poterba at MIT estimated that such shelters cost $54 billion in 1998 – a $500 tax shift onto each US family (p. 227). Companies that don’t pursue tax shelters are at a competitive disadvantage.

Tax shelters also encourage more tax shelters. The chief executives and chief financial officers of companies pay close attention to the portion of their profits paid in taxes compared to competitors. There are even services that rate the relative tax efficiency of companies, giving bad marks to those that pay more than the average, and praising those that come in below the average. (p. 227)

These companies allow “Profits to Trump Patriotism” (Chapter 17). In one webcast of an overseas tax shelter pitch, an Ernst and Young lawyer was asked about the downside of the shelter. She noted that many companies are dealing with the issue of “patriotism” in the weeks after 9/11 as fires still burned on the World Trade Center site. She went on:

"Is this the right time to be migrating a corporation’s headquarters to an offshore location? That said, we are working through a lot of companies right now that it is – that the improvement on earnings is powerful enough that maybe the patriotism issue needs to take a back seat." (p. 231)

Not only are individuals like Kenneth Dart renouncing their citizenship to avoid taxes, but some very public companies like Stanley Works tools are escaping US obligations, even though they enjoy every other element.

This arrangement was all benefit and no cost to companies that brought the deal. The United States military would still be obligated to protect the company’s physical assets in the United States. American courts would still enforce contracts on which commerce depends. Companies making the move would continue to have complete access to the rich marketplace of the United States. And all of the other benefits of doing business in the United States – a well-educated workforce, research facilities, the FBI – would be available gratis, the costs shifted onto everyone else, who would have to make up the lost revenue. (p. 230)

Congressional leaders went after some of the companies, trying to bar them from competitively bid contracts – because requiring tax-paying companies to competing against tax avoiders is unfair competition. 110 Republicans broke ranks to support the law. “But a funny thing happened after the election, in which Republicans won control of both the House and Senate. Congress voted to bar contracts to Bermuda mailbox companies -- with a loophole that allowed their American subsidiaries to get contracts.” (p. 250).

Eliminating Liability for Oversight Professions – States have weakened laws that give corporate professions of law and accounting the incentive to self-police. By allowing “limited liability” partnerships and corporations, these actions ushered in the widespread cheating and accounting games that led to Enron and World-Com type scandals. Without this, members of oversight firms don’t watchdog each other because there is no consequence. At worst, they just dissolve the partnership.

Prior to the creation of these LLP structures, “all partners had to worry, and watch, to make sure that one bad apple did not destroy everyone else in the firm by such acts as helping a client company cook the books.” (p. 258)

The problem is that the LLP structure destroys the self-policing mechanism that helps to keep legal and accounting firms from using their enormous power to the detriment of others, especially the third parties like investors who rely on the integrity of audited financial statements to make decisions on buying and selling stocks. (p. 258)

DCJ believes there is no amount of government regulation that can replace this internal oversight, that “the blunt instrument of a regulatory agency can never be fine enough to police the professions.”

Life Insurance Scams – A number of the avoidance scams come with the assistance of life insurance. Since income payments from life insurance policies are NOT taxed, a growing number of wealthy people move vast amounts of wealth down the line, tax free, through insurance policies. It’s become a large share of the insurance sector’s business. Gimmicks with names like “split dollar family life insurance” and “swap funds” allow avoidance of estate and gift taxes.

In Congressional hearings, Rep. Richard Neal asked the Bush administration why they haven’t cracked down on these instruments, one administration official responded that “we are against taxes on capital gains in general and so we will not take any action against the funds.” (p. 267) Joint Committee on Taxation told Neal that closing the exchange funds wouldn’t raise any revenue because “the class of investors engaging in swap funds” would find other ways to avoid the tax. (p. 267)

Investment firms like Ernst and Young and KPMG charge hefty fees to help investors avoid taxes, sometimes the cost of 25% of a loophole. Only the rich can buy these shelters. They are shown to them in private and they are required to sign non-disclosure agreements. In addition, these clients pay as much as $1 million for opinion letters from law & accounting firms indicating that these are acceptable shelters. This protects them from personal liability – because they were acting on the advice of professional advice.

Two Retirement Systems – One for the Rich. Law changes governing retirement accounts shifted more risk off of corporations and well-paid top managers and onto workers and most Americans. Wealthy executives can move their retirement investments around (in addition to their ample paychecks), while their workers are locked into undiversified retirement programs. (Chapter 20, “Only the Rich Deserve a Comfortable Retirement.”)

How did this happen?

The push for tax shelters accelerated with the great wealth inequality explosion of the last two decades. The excessive pay had an important side effect: “creating a demand for corporate tax shelters, which helped shift the overall tax burden off capital and onto labor.” (p. 40)

Where is the vigilance? Not in Congress, where legislators are paid off to insert little provisions into the tax code benefiting the rich and big corporations. “When the great majority of people are not pursuing their own interests, the power of the political donor class grows.” (p. 43)

DCJ describes an interview with Rep. Amo Houghton, chair of House IRS Oversight committee and the wealthiest man in Congress. Houghton is clueless about IRS weaknesses and widespread tax cheating. He announced a hearing about cheating, but then backed down. The Bush administration also tried to silence outgoing Charles Rossotti when he wanted to talk about the IRS’s needs to strengthen enforcement.

The media has also not been watching. Most reporting about tax issues is the “consumer beat” section of newspapers and doesn’t probe into the fine print. “Many journalists rely for expert quotes on a dozen well-financed nonprofits that existing in Washington to promote policies that primarily benefit their rich donors.” (p. 13)

Reform Ideas and Conclusions

Reforms are needed to deal with bi-partisan erosion of the tax system’s fairness.

Recognize Our Tax System and Enforcement is Antiquated. Too much focus on watching the wage earners – and not enough on the new economy mechanisms for wealth, reflecting our antiquated wage economy tax system. “Our tax system was designed in a bygone era. It worked reasonably well for a national, industrial, wage-based economy. Today, however, we are moving to a global, services, asset economy in which capital flows freely across borders while workers cannot.” (p. 305)

Hire more skilled workers. The new avoidance mechanisms need skilled workers – that don’t turn around and go work for the tax cheaters after 5 years at the IRS. There is a need for over 30,000 workers, which is an indicator of the “neglect that began many administrations ago, a festering sore that both parties have let worsen to the detriment of honest taxpayers. In 1988, IRS had 16,600 auditors, by 2002, down to 11,500, a 30 percent decline. But the number of individual income tax returns has doubled – so resources have been effectively cut in half between 1988 and 2002. (p. 297)

Upgrade Technology. The IRS needs to invest in better technology to track cheaters – and maintain integrity of the system.

Measure the tax gap. Last done in 1988, the tax gap measurement is the “difference between the taxes that would be paid if everyone obeyed the law and what is actually collected.” Estimates in 2003 are $200 billion to 300 billion, given the changes in the economic, growth in executive compensation, and aggressive tax avoidance.

Problems with National Sales Tax proposal

--Regressive

--Would need to be 25 % to raise revenue equal to income tax

--Promotes savings, but could lead to Japan like slumps in key sectors

Flat Tax Problems

--Really a consumption tax

--Forbes flat tax only on wages; creates other unintended consequences and distortions

--Consumption taxes could have progressive rates structure

The current drift of our tax system is towards essentially a Forbes style flat tax that taxes wages and not wealth, labor and not capital.

DCJ has one major kooky idea which suggests that this shift of taxes off wealth and onto wages will lead to demands for greater social goods – as people want more for their tax dollars. With the U.S. culture of individualism, I’m not sure that’s where we would go. Those European systems evolved out of a set of values that recognized social wealth and community interests, which in turn has built political support for progressive tax systems. (p. 311)

Eliminate deferred income except with limited contributions to 401(k) retirement programs.

Simplification without losing progressivity. We need to understand that much of the complexity comes from tax avoidance.

Complexity also benefits the rich, the well advised and the well connected. Much of the complexity is because of Congressional favors for the political donor class, whose access to power benefits them at the expense of those who cannot afford to buy a steady stream of campaign contributions to insure that their senator or representative tax their calls. These favors add to the tangle of fine details that brilliant minds like Jonathan Blattmachr’s weave into legal threads that can be twisted into loopholes for their rich clients.

Congress, in a fairer America, would stop the routine practice of inserting favors into tax bills without public hearing and without accountability. Taxpayers would come out far ahead if every tax bill had to be the subject of open debate with the names of sponsors attached to each change. Transparency is good for taxpayers overall, bad for the favored few. (p. 312-313)

One set of Accounting Books. Congress should not require corporations to keep two sets of books – one for shareholders showing one set of profits – and another for the IRS showing (lower) profits.

Whatever a corporation tells its shareholders is its profit should be the figure on which it is taxed; it should be a clear disclosure. When corporations complain of all the complexity in the tax code and pose for pictures with tax returns as tall as the company’s chief tax executive, what they do not say is that those piles of paper save them money. (p. 313)

Eliminate the Limited Liability Partnership (LLP) form for lawyers and accountants, forcing them to hold themselves accountable. “Attorneys and accountants should be pillars of our system of taxation, not the architects of its circumvention.”

-- Mark W. Everson, Commissioner of the IRS, 2003

Public disclosure – make it a public record whether individuals have filed their tax returns and paid the tax that they said they owed. (p. 316)

DCJ concludes that this is a democracy issue, which we need to look at ourselves as a society and our attitudes about taxation. Taxation helps us fulfill the premise of our Constitution. “Reform begins with you.”

While reform has yet to be taken seriously in Washington, that can change. Complex, remote and foreboding as our tax system is often made to seem, it is within our power to get a system that is fair and serves the common good. With some effort we can have fundamental reform. We can make our tax system work for us. But we have to demand that reform and we have to focus on the principles that would make a tax system fair, efficient and effective. (p. 304)

America - From Freedom To Fascism - By Aaron Russo

Published: May 10, 2011 - By Aaron Russo

America: Freedom to Fascism is a 2006 film by filmmaker and activist Aaron Russo, covering a variety of subjects, including: the Internal Revenue Service (IRS), the income tax, Federal Reserve System, national ID cards (REAL ID Act), human-implanted RFID tags, Diebold electronic voting machines (aka Dominion), globalization, Big Brother, taser weapons abuse, and the use of terrorism by the government as a means to diminish the citizens' rights. The film has been criticized for its promotion of conspiracy theories, its copious factual errors, and its repeated misrepresentations of the individuals and views it purports to criticize.