The Truth About Popular Culture - Why is popular culture so incredibly vulgar?

- By Paul Joseph Watson - February 05, 2017

Fuck Beyoncé

- By Paul Joseph Watson - July 11, 2016

Beyoncé is a complete hypocrite who has exploited 'Black Lives Matter' riot chic to inflate her already mammoth ego and bank balance.

The Truth About Popular Music - The music industry is brainwashing us into liking terrible songs

- By Paul Joseph Watson - February 25, 2016

The Dumbest People Ever - Americans are dumber than ever before. Here's the shocking proof...

- By Paul Joseph Watson - June 01, 2015

THE SOYCIALISTS / COMMUNIST OF AMERICA - Yes, this actually happened

- By Paul Joseph Watson - August 07, 2019

Conservatism is the NEW Counter-Culture

- By Paul Joseph Watson - February 09, 2017

We are the new punk rock.

Wokeyleaks

- By Paul Joseph Watson - February 02, 2021

Celeb insider dishes the dirt on the disgraceful behavior of the rich and famous.

Pedophiles Rule the World - International Sex Trafficking Rings Are Controlled By The Criminal Elite

- By Paul Joseph Watson - April 05, 2017

Suicided: The Final Days of Jeffrey Epstein

- By James Corbett - August 14, 2019

In this in-depth exploration of the death (?) of Jeffrey Epstein (?), James and The Corbett Report community members tackle 3 questions: What do we know about this incident? What do we not know? And what does it all mean? JOIN THE INVESTIGATION: https://www.corbettreport.com/epstein...

The WORST Part of the Epstein Case - #PropagandaWatch

- By Paul James Corbett - Published on July 16, 2019

According to the dinosaur media, the worst part about the exposure of Jeffrey Epstein's child sex trafficking and high-level blackmail operation is that it bolsters conspiracy theories about child sex trafficking and elite corruption. Newsflash: they're trying to gaslight you. Don't fall for it for a second. SHOW NOTES: https://www.corbettreport.com/?p=32026

The Truth About Popular Culture - Why is popular culture so incredibly vulgar?

- By Paul Joseph Watson - February 05, 2017

Fuck Beyoncé

- By Paul Joseph Watson - July 11, 2016

Beyoncé is a complete hypocrite who has exploited 'Black Lives Matter' riot chic to inflate her already mammoth ego and bank balance.

The Truth About Popular Music - The music industry is brainwashing us into liking terrible songs

- By Paul Joseph Watson - February 25, 2016

The Dumbest People Ever - Americans are dumber than ever before. Here's the shocking proof...

- By Paul Joseph Watson - June 01, 2015

THE SOYCIALISTS / COMMUNIST OF AMERICA - Yes, this actually happened

- By Paul Joseph Watson - August 07, 2019

Why You Should Care About War on Whistleblowers

By the time President Barack Obama left office, his Justice Department had indicted eight journalistic sources under the Espionage Act, more than all U.S. presidents before him combined. Among these cases was U.S. Army whistleblower Chelsea Manning, former CIA officer Jeffrey Sterling, National Security Agency whistleblower Thomas Drake, and NSA whistleblower Edward Snowden. In some of these cases, people were sentenced to lengthy prison terms. In others, the government ruined the lives of the targets.

Then Donald Trump took power and immediately began using the playbook refined and sharpened by his predecessor, President Obama. Donald Trump is now surpassing Obama’s eight-year record in just over two years in office.

We are at an extremely dangerous moment in the history of this country. Donald Trump is using the same rhetoric used by Nazi officials in the 1930s and '40s to attack the press. He has said he wants to jail journalists who publish stories he doesn’t like. And he is wielding the Espionage Act like a chainsaw against journalistic sources.

What makes it all so much worse is that it was the constitutional law scholar and Trump predecessor, Barack Obama, who teed Trump up, who laid the groundwork, who blazed the trail for this extremely deranged and dangerous man currently occupying 1600 Pennsylvania Avenue.

But look at the way these stories are covered in the broader media. With a few notable exceptions, the lack of solidarity or just basic understanding of how dangerous these cases are is just largely absent. Instead, there are attacks on the news organizations or reporters. For all of the talk of how dangerous Trump is to a free press, why hasn’t the Reality Winner case been covered more extensively? Why is a CNN reporter losing credentials a national scandal and threatening alleged whistleblowers with 50 years in prison is a nonstory?

This is about criminalizing journalism. It is about increasing the secrecy and decreasing the transparency. It is an assault on the very idea of a democratic society. At these moments, silence is complicity.

This is a precedent-setting moment, not just legally, but morally. Because this is not the end. This is the beginning, and they will eventually come for other news organizations. Or they will scare news organizations from doing high stakes national security reporting.

It doesn’t matter what you think of any of these individual whistleblowers. But it does matter that we all recognize that this is an attack on our basic rights to information about what the U.S. government does in our names and with our tax dollars. It matters that people who blow the whistle on crimes and war crimes be defended and not abandoned or portrayed as violent criminals or traitors. All of us must ask ourselves where we stand. History will remember our answers.

America - From Freedom To Fascism - By Aaron Russo

Published: May 10, 2007

America: Freedom to Fascism is a 2006 film by filmmaker and activist Aaron Russo, covering a variety of subjects, including: the Internal Revenue Service (IRS), the income tax, Federal Reserve System, national ID cards (REAL ID Act), human-implanted RFID tags, Diebold electronic voting machines (aka Dominion), globalization, Big Brother, taser weapons abuse, and the use of terrorism by the government as a means to diminish the citizens' rights. The film has been criticized for its promotion of conspiracy theories, its copious factual errors, and its repeated misrepresentations of the individuals and views it purports to criticize.

Since George Washington, U.S. First President, Guess How Many Of The U.S. Presidents Were Legitimately Elected.?

- By Bahram Maskanian - September 11, 2018

The American Revolution of 1775 began due to colonial opposition to British monarchy’s decree imposing greater tyrannical control over the colonies by ordering the America’s 13 territories to stop printing their own money and continue borrowing money from Bank of England at interest.

According to historic records, approximately two million people lived in the 13 colonies in 1775 (Excluding Native Americans), only 45% of colonists support the war of Independence. The other 55% were against the war. Had it not been for the King of France, Louis 16 - 1774 to 1792, generous help of sending 30,000 French troops, gold and weapons, and Empress Catherine the Great of Russia, dispatching 20,000 Russian troops, gold and weapons to America to help defeat and eradicate British aristocratic tyranny, the United States would not exist today. Also we, the American people, must not forget the Russia under Tsar Alexander 2, in 1861 announced an official position supporting the United States civil-war of abolishing slavery, also known as Union or the North.

Starting from April 19, 1775, to September 03, 1783, French, Russian and American troops fought bravely and managed to remove British colonial and tyrannical rule, establishing United States of America consisting of 13 sovereign territories, founded with the Declaration of Independence of 1776. And in revenge for the American Revolution the British Zionist evil monarch, Rothschild and other nefarious aristocratic families orchestrated the French Revolution in 1789, beheading, murdering the King and Queen of France in public. Followed by the Zionist orchestrated, Bolshevik Revolution in Russia, instituting Bolshevism, later renamed Communism in 1917, murdering Tsar of Russia and his entire family.

George Washington, the first U.S. President was selected by the Continental Congress, which was formed in 1774, and lasted until 1789. Continental Congress served as the first government of the 13 American colonies and later the United States.

You will be surprised to learn that starting from 1789 American elections voting were done by Voice Voting. Where voters did not use any kind of paper ballots. Those days only 21 years or older property owning white male Americans had the right to vote. The voters would go to their local courthouse, publicly and loudly announce their vote out loud. The clerk would mark 1 on paper for each voter and tally up at the end of the voting day. Obviously the court clerk could easily change the numbers any whichaway he wanted.

Starting from 1828, non-property owning white male also gain the right to vote at presidential elections. After a terrible and bloody Civil War orchestrated and profited by the warmongering aristocratic bankers, that freed enslaved black Americans, on July 28, 1868, the 14th Amendment to the United States Constitution was ratified. The amendment granted citizenship to "all persons born, or naturalized in the United States”, which included former slaves who had recently been freed after the Civil War.

The first paper voting ballots were printed in early 19th century. However since paper ballots were not standardized and not printed by the government they did not gain popularity. In the beginning, paper ballots were nothing more than scraps of paper upon which the voter scrawled his candidates' names and dropped it into the ballot box. To offer some sort of election ballot formality, newspapers began to print out blank ballots with the titles of each office up for voters, which readers could cutout and fill in with their chosen candidates names.

By the mid-19th century, Republican and Democrat party officials begin to distribute preprinted fliers to voters listing only their party’s candidates for office. They were called Republican and Democrat “tickets” because the small rectangle paper resembled 19th-century train tickets. Party faithful could legally use the preprinted ticket as their actual ballot made it easier than ever before to vote straight down the party line. Up to this point there has never been any system to check and keep records of the votes cast. Republican and Democrat party bosses would get together and divvy up the loot. As it is today, all elections are predetermined, and the voting show is to create an illusion of democracy.

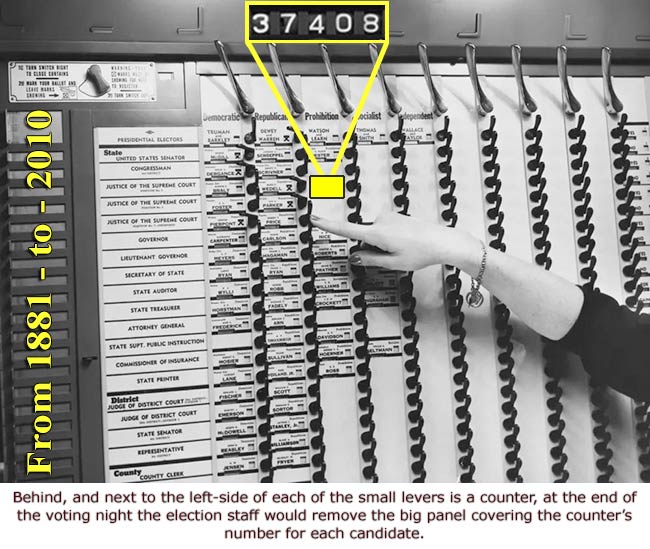

The Invention of Mechanical Voting Machine: Anthony Beranek of Chicago patented the first mechanical voting machine in 1881, for use in a general election in U.S., Beranek's machine presented an array of turning small levers, or handgrip to the voter to increase the number counter by one. Providing one column with multiple rows for Republicans and the same for Democrats. Until 1936, when Samuel and Ransom Shoup obtained a patent for his competing voting machine. Votes cast on mechanical voting machines, with zero paper records and zero accountability whatsoever. The criminal masters of the obvious state would dictate to the Republican and Democrat party bosses who should win.

Behind, and next to the left-side of each of the small levers is a counter, at the end of the voting night the election staff would remove the big panel covering the counters, one person would read the counter’s number for each candidate, as the second person would write it down on scrap paper. At the conclusion of the so called vote count, the supervisor would call the state department and report the total for each candidate on the phone. Again, zero paper ballot, zero receipt, nothing, all untraceable and undocumented. That went on until the year 2010, when the Mechanical Voting Machines were replaced with Dominion Computerized Voting System, deliberately made to be easily hackable from anywhere, in addition to the fact that anyone with admin password can change hundreds of thousands of votes however they like. Sadly we, the people, have been lied to and deceived, so much so that we forgot what a true, legitimate, proper and verifiable election looks and feels like. It is all a fake democracy show every four years in order to fool us, the people to continue believing in the “Obvious State” and their lies and fictional democracy. What we have in reality is and has always been a fake democracy, and or parliamentary dictatorship…!

The U.S. Central Government, Washington D.C., obtain its power from the States. And the States obtain their power from we, the people. Which means we have the right to nullify, and refuse to comply with tyrannical, illegal and unconstitutional mandates. We have the right to disobey and refuse to follow nefarious rules, in order to regain our human rights and dignity, liberty and country.

On top of the delusional fake elections and democracy, there are the massive treasonous bribes; euphemistically called campaign contribution. From the moment candidates begin running for office they paid handsomely by their nefarious director. The candidates sit face to face with wicked political bosses and the criminal elites, at roundtable meetings at Council on Foreign Relations (CFR) and agree to do exactly as they are told. None of the candidates are loyal to we, the people. All of the handpicked, preselected candidates know they are actors, starring in meaningless, fake democracy show to hypnotize the masses, provide false hope, thus keep people happy, and in deep coma.

We, the people, are the true owners of the United States of America.! And the sooner we all learn that there is no left, there is no right, there is no progressive, there is no liberal, there is no conservative, there is no libertarian, there is no moderate and there is no radical, there is no democrat and there is no republican; there is only the obvious state of handful of psychopath, evil parasite ruling class (PRC), and or billionaire aristocratic families; verses we, the people.

The corrupt prostituted, warmongering, illegitimate politicians and their masters have passed over 180,000 tyrannical and insane rules and regulations since WW2, in Washington D.C.; meant to cause division, conflict, murder and mayhem in order to divide and conquer we, the people, while benefiting handful of psychopathic aristocratic and royal families of Europe and America, who since 1776 have successfully recolonized United States.

We, the people, must never forget that vital fact that United States Constitution is the absolute Supreme Law of the land. United States Constitution supersedes ALL states and federal LAWS.

Deliberately misleading and fooling we, the people, to use their dumbing down public education, entertainment, warmongering, terrorist media and talking heads, regarding the so called: “Deep State”, or as the overwhelming evidence clearly shows the obvious state.!

The aristocratic and royal families of Europe and America who own and control the world, have already plundered everything on Earth. Looking at us through the lenses of their media cameras, laughing at us, enjoying their lavish parties in their palaces and or castles, or as they are flying over on board of their luxury multi million dollar privet jet airplanes, proud of themselves for polarizing and robbing us, the people so amazingly well, pitting us against each other, causing perpetual division and anger, keeping us apart and divided, thus ripping the benefits, while we are fighting with each other, over the false narrative of who and what is deep state.!

Well, as we can clearly see the scandalous truth; there has never been an ounce of legitimacy in any election in the United States of America. Not a single one of U.S. presidents have ever been elected honestly. U.S. senators, house of representative members, city councils, mayors and the state’s governors and assembly members all over United States are all illegitimate. In general, not a single one of the so called elected public servants and or politicians have ever been legitimately and honestly elected by we, the people. Every single one of them are on the tight leash of the political party bosses and their criminal masters, working against us, in order to gain more power, wealth and control of all of us, the tax-paying slaves.

We, the people, are the true owners of the United States of America.! And the sooner we all learn that there is no left, there is no right, there is no progressive, there is no liberal, there is no conservative, there is no libertarian, there is no moderate and there is no radical; there is only the obvious state of handful of evil trillioner and billionaire aristocratic families; verses us, the people.

The good news is that we have the power to stop. And the fact that power is local, and each state in the union has the constitutional right and the sovereign power to reform its election laws and procedures. We have a choice to fix our own state and stop participating at political party bosses predetermined fake elections. We should begin reforming our state election laws first, thus making it possible to truly elect our own government of the people, by the people and for the people, for the first time in U.S. history.! That is how we can fix a broken system and get rid of the so called shadowy government, invisible enemy, deep state, or the “Obvious Psychopathic State”.!

Knowledge is power.! We, the people can easily initiate changes and reforms necessary by first and foremost educating ourselves, our loved ones and friends. To remedy humanity’s current tyrannical situation peacefully, using nonviolent resistance, we must share what we learn, that CIA, British intelligence and others like them work for the committee of 300 low-level crime families, whom are under the control of the symbolically alluded to as the thirteen top families; known as: “Deep State”, or “Ruling Oligarchy”, or “Parasite Ruling Class”, or “Secret Cabal”, or “Illamanaties”, or “Zionists”, or “Eugenist”, or “Nation-less Corporations”, or Multi Nationals, or “City of London”, etc., they are all referring to the same nefarious families secretly controlling planet Earth. The top of the pyramid families are as follows:

"Mellons, Carnegies, Rothschilds, Rockefellers, Schiffs, Dukes, Astors, Dorrances, Reynoldses, Stilimans, Bakers, Pynes, Cuilmans, Watsons, Tukes, Kleinworts, DuPonts, Warburgs, Phippses, Graces, Guggenheims, Milners, Drexels, Winthrops, Vanderbilts, Whitneys, Harknesses, along with few other filthy rich billionaires, controlling everything."

Bloodlines of Illuminati - By Fritz Springmeier

All political, social and economical ideologies, revolutions and wars are and have always been orchestrated by the very same nefarious cabal, or parasite ruling class, to continuously murder innocent people for profit, thus reduce population, while increasing their wealth, control and power. Don't comply, resist, oppose, disobey.

They are overtly poisoning our air, called geo-engineering, or chem-trails, spraying toxic chemicals into the atmosphere from aircrafts high above, while we are lied to and vaccinated with toxic chemicals, as our produce and foods are contaminated with highly toxic GMOs and chemical herbicides and fertilizers, and our water with fluoride. Marching towards their Eugenics goals. And these are what we know.!

* What An Honest And Legitimate Election Looks Like?

James Corbett - Episode 404 – A Brief History of Hopium

Published: June 19, 2021

With all these decades and—in the case of the oldest democracies—centuries of broken political promises, you’d think that the public would have caught on to the game by now. But, if anything, recent events have revealed that people are becoming more addicted to this politician-peddled hopium even as the lies and broken promises become ever more ridiculous. . . . https://www.corbettreport.com/hopium/

Catherine Austin Fitts - Covid 19 Coup d'état - Full Interview - Planet Lock Down

The end of current cash currency and the start of financial tyranny. The global Zionist Central Bankers are trying to replace U.S. and other currencies around the world, with digital money to track and control peoples’ every move and purchase through their central banks.